4 Easy Facts About Eb5 Investment Immigration Shown

4 Easy Facts About Eb5 Investment Immigration Shown

Blog Article

Eb5 Investment Immigration for Dummies

Table of ContentsExcitement About Eb5 Investment ImmigrationThe Eb5 Investment Immigration StatementsSome Ideas on Eb5 Investment Immigration You Need To KnowThe 5-Second Trick For Eb5 Investment ImmigrationSome Ideas on Eb5 Investment Immigration You Should Know

While we aim to supply exact and up-to-date material, it must not be thought about lawful guidance. Migration regulations and regulations are subject to alter, and individual conditions can vary extensively. For personalized assistance and legal guidance regarding your specific immigration situation, we strongly suggest seeking advice from a certified migration attorney that can provide you with tailored aid and ensure conformity with present regulations and guidelines.

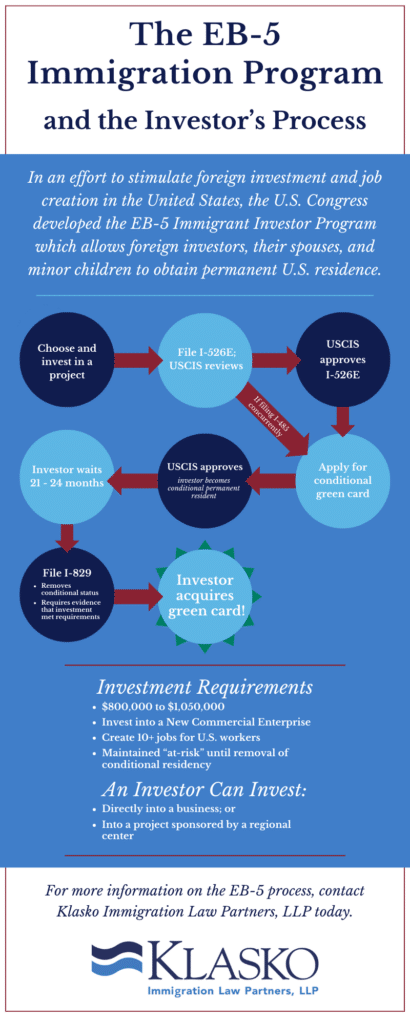

Citizenship, with financial investment. Currently, as of March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Areas and Country Areas) and $1,050,000 elsewhere (non-TEA areas). Congress has approved these quantities for the following five years beginning March 15, 2022.

To get approved for the EB-5 Visa, Financiers need to produce 10 permanent U.S. work within two years from the day of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that financial investments contribute directly to the united state job market. This applies whether the tasks are developed directly by the company or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Not known Details About Eb5 Investment Immigration

These tasks are figured out through versions that make use of inputs such as growth costs (e.g., building and construction and devices expenses) or annual profits produced by ongoing operations. On the other hand, under the standalone, or direct, EB-5 Program, only direct, full time W-2 employee positions within the company might be counted. A crucial risk of counting exclusively on direct employees is that staff reductions because of market conditions might cause insufficient permanent settings, possibly leading to USCIS denial of the capitalist's application if the work development requirement is not fulfilled.

The economic version then forecasts the variety of straight jobs the new organization is likely to produce based on its awaited profits. Indirect tasks calculated with economic models refers to employment produced in markets that supply the items or services to business directly associated with the task. These tasks are produced as an outcome of the increased need for items, materials, or services that sustain the company's procedures.

Eb5 Investment Immigration for Dummies

An employment-based fifth choice category (EB-5) financial investment visa gives a technique of ending up being an irreversible U.S. citizen for international nationals wanting to spend resources in the United States. In order to apply for this eco-friendly card, an international capitalist has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Area") and create or preserve at the very least 10 permanent work for USA workers (leaving out the investor and their prompt family).

This measure has actually been an incredible success. Today, 95% of all EB-5 resources is increased and spent by Regional Centers. Since the 2008 financial crisis, accessibility to funding has actually been restricted and municipal budgets proceed to face significant deficiencies. In many areas, EB-5 financial investments have loaded the financing gap, supplying a new, important source of funding for neighborhood financial growth projects that revitalize areas, create and support work, facilities, and solutions.

Some Ideas on Eb5 Investment Immigration You Should Know

Even more than 25 nations, including Australia and the United Kingdom, usage comparable programs to bring in international investments. The American program is a lot more stringent than many others, calling for significant risk for financiers in terms of both their financial investment and migration condition.

Families and individuals that look for to relocate to the United States on an irreversible basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) established out numerous needs to acquire long-term residency through the EB-5 visa program.: The very first step is to find a qualifying investment possibility.

Once the chance has actually been recognized, the investor must make the financial investment and submit an I-526 application to the U.S. Citizenship and Migration Services (USCIS). This request needs to consist of evidence of the investment, such as financial institution statements, purchase agreements, and business plans. The USCIS will certainly assess the I-526 petition and either authorize it or request additional evidence.

Not known Facts About Eb5 Investment Immigration

The investor must look for conditional residency by sending an I-485 request. This request blog should be submitted within 6 months of the I-526 authorization and should include proof that the investment was made and that it has actually produced at the very least 10 full time jobs for united state employees. The USCIS will certainly evaluate the I-485 petition and either accept it or request extra evidence.

Report this page